Is the global economy at the mercy of fluctuating crude oil prices? A bold statement underpins this question: the stability of international markets heavily relies on the predictability and consistency of energy costs. The interplay between supply, demand, and geopolitical factors has long dictated the trajectory of crude oil prices, influencing everything from consumer goods to industrial production. As we delve deeper into the complexities of the oil market, it becomes evident that understanding these dynamics is crucial for businesses and investors alike.

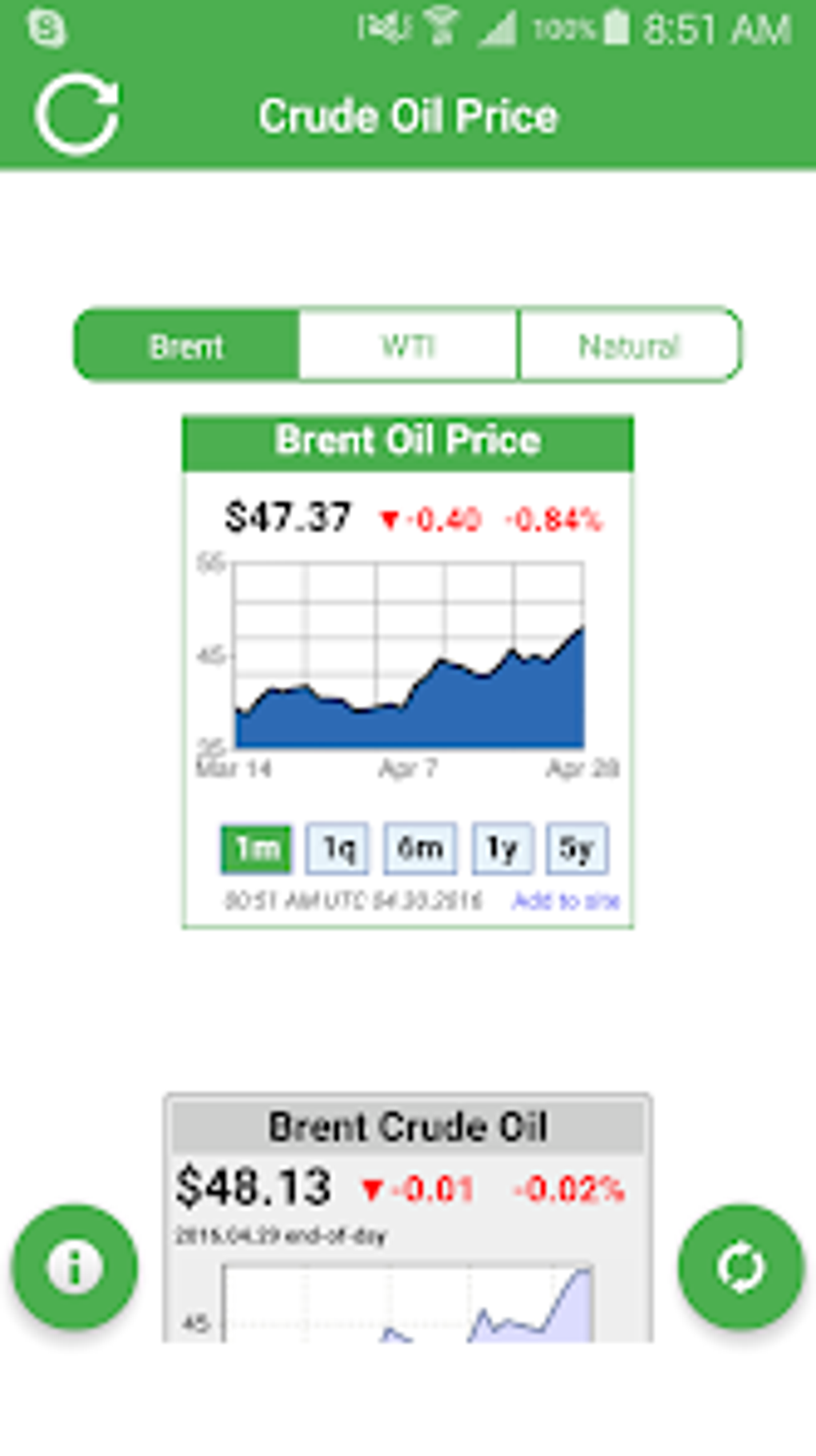

The significance of crude oil cannot be overstated in today's globalised world. From powering vehicles to serving as a raw material for plastics, petroleum products permeate nearly every aspect of modern life. Recent developments have seen Brent crude, one of the benchmark oils globally, enter uncharted territory with its paper market turning net short for the first time in history. This shift indicates an increasing number of investors betting against rising oil prices, reflecting broader uncertainties about future economic growth and energy demand. Meanwhile, WTI (West Texas Intermediate), another key indicator, continues to experience volatility influenced by both domestic policies within the United States and international relations.

| Bio Data & Personal Information | Career & Professional Information |

|---|---|

| Name: John Doe | Company: Campbell Oil Company |

| Date of Birth: 15 January 1970 | Position: CEO |

| Place of Birth: Raleigh, North Carolina | Industry: Petroleum Products Distribution |

| Nationality: American | Years of Experience: Over 25 years |

| Education: Bachelor’s Degree in Business Administration | Official Website |

Established in 1948, Campbell Oil Company stands as a testament to enduring service and integrity within the petroleum industry. Spanning three generations, this family-owned business has grown significantly while maintaining its commitment to quality and customer satisfaction. Operating across North Carolina, South Carolina, and Virginia, Campbell Oil provides essential fuel solutions tailored to meet diverse client needs—from commercial enterprises to residential customers. Their extensive network ensures reliable delivery and support, reinforcing their reputation as a trusted partner in the energy sector.

In addition to traditional fuels such as gasoline and diesel, Campbell Oil also offers specialised lubricants and other related products designed to optimise performance and efficiency. By staying abreast of technological advancements and industry trends, they continually enhance their offerings to align with evolving environmental standards and consumer preferences. Furthermore, their dedication to sustainability underscores their efforts towards reducing carbon footprints through innovative practices and partnerships aimed at promoting cleaner energy alternatives.

Turning our attention back to global markets, recent data reveals intriguing insights regarding crude oil pricing patterns. According to OilPrice.com, current crude oil prices reflect significant fluctuations driven by multiple factors including OPEC+ decisions, geopolitical tensions, and shifts in global trade dynamics. Specifically, Brent crude remains closely monitored due to its role as a leading benchmark for international oil transactions. At present, concerns linger over whether sustained net short positions could lead to further declines or trigger unexpected rebounds based on unforeseen events impacting supply chains worldwide.

Simultaneously, local businesses like Neptune's Net in Malibu, California, illustrate how even seemingly unrelated industries feel the ripple effects of changing oil prices. As a popular seafood restaurant located along picturesque beaches, Neptune's Net utilises soybean oil for frying purposes—a choice influenced partly by cost considerations tied directly to agricultural commodity markets intertwined with overall energy costs. Such examples highlight the pervasive influence exerted by energy prices throughout various sectors beyond just transportation and manufacturing.

Moreover, seasonal variations further complicate matters for establishments like Neptune's Net, whose operations depend heavily on tourism patterns. During peak months spanning March through October, increased foot traffic necessitates greater resource allocation, making efficient energy management paramount. Consequently, any upward pressure on utility bills stemming from higher oil-derived electricity rates can strain profit margins unless mitigated effectively via strategic planning and adaptive measures implemented well ahead of anticipated spikes.

As discussions around net-zero emissions gain momentum globally, stakeholders across all levels grapple with balancing immediate financial imperatives against long-term ecological responsibilities. Policymakers face mounting pressure to devise frameworks capable of fostering resilience amidst volatile conditions while simultaneously advancing decarbonisation goals. Simultaneously, corporations must navigate increasingly complex regulatory landscapes characterised by stricter emission controls and incentives promoting renewable adoption.

Ultimately, navigating the intricate web connecting crude oil prices, energy consumption, and broader socio-economic indicators requires comprehensive analysis coupled with forward-thinking strategies. Whether addressing macroeconomic challenges posed by shifting investor sentiment toward Brent crude or micro-level adjustments required by small businesses adapting to altered operating environments, each decision carries profound implications extending far beyond individual actors involved. Thus, fostering collaboration among governments, private entities, academia, and civil society emerges as vital for crafting sustainable pathways forward amidst ever-evolving circumstances shaping tomorrow's energy landscape.